Funding and Selling/Marketing

Entrepreneurship for mathematicians

Summary of today’s lecture

- Part 1:

- What is a company?

- Equity vs Debt vs Grants. Valuation

- Who do you raise money from?

- Part 2:

- A lot of this course is going to be about “selling”

- Selling (or marketing) is the heart of everything as an entrepreneur

- How to understand and manage the interactions with customers

- Closing deals

- Discounts, special deals, cornerstone customers

Fundraising

How does a limited company work?

- Investors (you, or other people) give the company money in return for shares

- As shareholders, they collectively own the company

- They own a share of everything

- The profits now and in the future

- The assets of the company (money, computers, intellectual property, invoices not yet paid)

- But they are mostly not liable for the debts of the company

- Loans

- Payments to suppliers

- Contractual obligations

- This is the magic of the “Limited Liability Company”

- There are alternatives (partnerships, charities, sole-trader etc)

The LLC

- Relatively cheap to set up

- Obligations for regular reporting and accounts

- You need to keep records

- Register shareholders, directors and the company secretary

- Register persons with significant control

- Debts, assets, stock, suppliers, goods bought and sold etc etc

- Keep them for at least 6 years

- All the records are public on Companies House

- Bank account, accountants, bookkeepers, lawyers

- Pretty much obligatory if you’re going to start something

Shareholders

- When a company starts people buy shares

- Initially there will just be some random amount like 1,000 shares at 1p each.

- You pay the £10 to the company’s bank acount and…you own all the company.

- But you’re not going to get far with £10

- So you sell some of those shares to other people for more than 1p

- And you have some equity to spend on building your company

- Shareholders have rights and obligations

- A share of the profits after corporation tax

- Vote on shareholder resolutions

More complex setups

- Different types of shares

- Ordinary

- Classes with more or less voting rights

- Shares with pre-emption rights on subsequent share issues

- Tag along, drag along

- All described in the articles of the company

- Get a lawyer to write the articles – they’re mostly boilerplate at this stage

- Shareholders vote on changing the articles of the company

Board of Directors

- Chairperson and directors

- Keep official minutes of every meeting

- Boards represent the shareholders and can get into trouble if they make decisions which impact shareholders adversely

- Strictly, the board of the company appoint the managers of the company

- But it’s all more nuanced than that

- Founders are almost always on the board and early on they’re normally the largest shareholders

- Investors have no automatic right to be on a board but they might insist

- Boards generally vote on resolutions by headcount but if they are disagreeing, you’re already finished

- Capital raises and other major events are often voted on by shareholding

Raising Money

- Primarily as an early stage company, this involves raising equity

- That is either selling some of your shares or issuing new shares

- You offer to sell some percentage of your company to the investors

- At some notional value

- Everybody argues about the notional value all the time

- You go through multiple rounds of raising equity

- All the time selling little (or big) slices of your company to somebody

- Good rule of thumb is 20% at each round

- \(0.8^N\) is a small number for even quite small \(N\)

- Hopefully at higher and higher valuations

Valuation

- A dark art

- Let’s take an example

- You’ve come up with an algorithm that will reduce the energy to train AI Networks by 90%

- You’ve got some mathematics and some demo software

- What’s that company worth right now?

- What could that company be worth?

- It’s all just a massive guess

- What matters is how much money you need to get to the next stage

- And how much equity you’re willing to give away

- Or more likely, how much equity the investors demand given the risk

Example

- Say you need at least £2m to get to the next stage. This could be a huge £10bn business!

- You offer 20% of your business for £2m

- Your pre-money valuation is £10m. When the money comes in, the post-money is £12m

- From your perspective

- When the business is worth £10bn, you’ve made £8bn. Woo hoo.

- When the business goes bust, you walk away

- From the investors perspective

- When the business is worth £10bn, they’ve made £2bn (a 1000x return)

- When the business goes bust, they’ve lost £2m.

- Risk reward tradeoff

In reality

- What’s to stop you just wasting the money?

- You’re going to need many rounds of equity where you’re getting diluted

- The equity is almost always priced by investors not by founders

- Maybe your mathematics doesn’t work

- Maybe you can’t find a business model that works

- Maybe you’re only worth £100m in the future

- “Prediction is hard, especially about the future”

- Early stage equity raises are hard

- More “proof-points” is really really good

Other sources of funding

- Self supported

- “Friends and Family”

- Probably more likely to believe your crazy idea

- Grants and other non-dilutive funding

- Various parts of the Cambridge Ecosystem

- Innovate UK

- Regional grants

- Non-profits

- “In kind” donations

Debt

- As a company, if you borrow money you have to pay it back

- The rights of debt holders sit “above” the rights of shareholders

- If the company gets into trouble, the debt holders take it over

- The equity holders get wiped out – including you

- Convertible notes are debt

- Effectively lend the company money with the promise to convert into equity later

- You can “borrow” money from your suppliers by paying them late. Don’t do this

- You can “borrow” money from the government by paying your taxes late. Really don’t do this

- Debt has limited upside (5%-10% per annum) and unlimited downside

Hierarchy

- HMRC

- Secured Creditors

- Unsecured Creditors (suppliers etc)

- Employees

- Shareholders

Raising Money (Founding stage)

- Primarily founders own money (and time)

- Split of equity between founders is difficult to get right

- You’re stuck with these people for a long time

- Friends and family

- Grants

- You’re aiming to get to a proof of concept

- And a decent business plan

- You can offer equity to people you want to work with

- The founders probably get to the end of this stage with 90% to 100% of their equity intact

- Maybe £100k-$250k (ish)

Raising Money (Seed)

- Angel investors

- Seed VC funds

- Early stage accelerators

- More grants

- Corporate relationships

- Some invest money for early access

- Some “invest” services like Google or Amazon

- £250k-£2m+

- Another 10-20% of your equity will be gone

- This is one of the highest risk places to invest so investors will want to see some chance of 20x+ return on their investment

Raising Money (Series A)

- By this point you’ve probably got a product

- You might even have customers and revenues

- You’re close to £1m annual recurring revenue

- You’ve got a plan to be profitable

- VCs

- Lots of pitches, very few hits

- £5m-£10m investment

- Another 10%-30% of your equity is gone

- Expect board participation from the VC

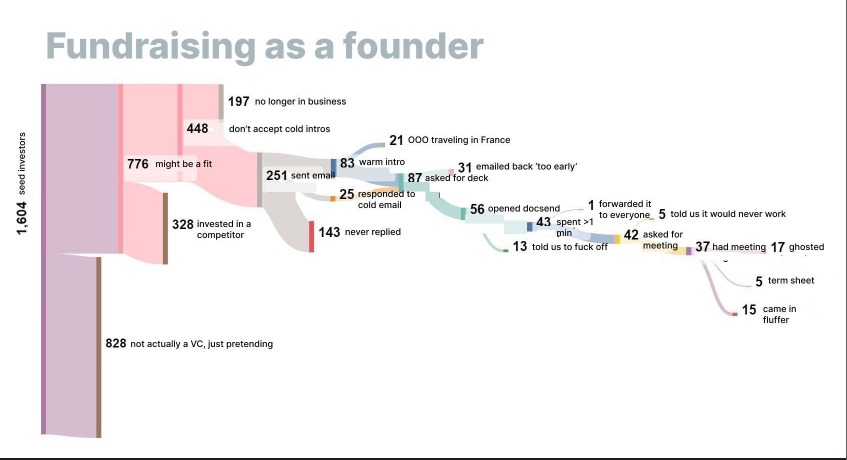

What it’s really like

Raising Money Beyond Series A

- Can’t really generalise about this

- What’s the exit?

- How much money do you need to grow

- At this point you’re a grown up business and you don’t need my advice

Summary

- Raising money is one of the primary jobs as a founder of a firm

- Once you’ve closed a round, you should be starting to think about the next round

- If you’ve got some seed round money, start talking to VCs

- “We’re a bit early for you right now but here are the things we’re going to do in the next 12 months in preparation for our Series A”

- Be prepared for dilution

- Be prepared for onerous terms which involve the investors taking over your business if you mess up

- Almost everybody says no. It’s depressing sometimes

Selling

Everything is about selling

- It’s basically all you do when you’re an entrepreneur

- You sell to investors

- You sell to customers

- You sell to your advisors

- You sell to your employees

Marketing vs Selling (the received wisdom)

- Marketing is about customer satisfaction. It starts with customer needs and demand and ends with customer satisfaction. It is a customer-oriented approach. Sales, on the other hand, is about selling what the company produces. It doesn’t care about the need of the customer but about the profits.

- Marketing is about providing quality products and consumer satisfaction. Selling is about generating by maximising sales and is a money-oriented approach.

- In marketing, emphasis is given on the wants of the consumer. Whereas in selling, emphasis is on the company’s products.

- Marketing is different from selling because here the company first determines customers’ needs and wants and then decides how to deliver a product to satisfy these wants. In selling, it is the other way round.

- blah blah blah

Marketing vs Selling

- They’re basically the same thing

- Or at least points on a spectrum

- Maybe marketing is a little bit more about strategy

- Maybe selling is a little bit more about closing a contract or a customer

- Being “Chief Marketing Officer” or “Business Development Director” is a cooler job title than “Head Saleswoman”

- If you’re Heinz or Tesla or Barclays they are different

- But you’re not Heinz or Tesla or Barclays

- As a startup founder, you just need some customers to buy your product of service

Marketing/Selling is a skill

- Like all skills it can be learned

- Like all skills, some people are naturally quite good at it

- You can hire people to sell/market for you

- They will have done it before

- They will have learned the skills

- They may be good at it

- They are very good at selling themselves so beware

- But as the founder/leader of a business, you’ll be intimately involved in the sales and marketing process for a very long time

How do you learn this stuff

- And about 5 billion other books

Learning selling and marketing

- These books are all terrible

- But you should probably read at least one of them

- Learn from other people

- Your own sales team

- Situations in which you are being marketed to

- Buying a TV

- Buying a car

- etc

- Learn from bad salespeople as well as good ones

- What do they do wrong?

- Why are you hating the whole process of being sold to?

Go to market

- What is your “market”?

- First work out who your customers are likely to be (make a list)

- Are they consumers or businesses or government or academia?

- Presumably you’re not targetting every member of the customer group

- What are the characteristics of your initial customer group?

- Remember…what do they need?

- Do research into your customers

- Do more research into your customers

- If you don’t understand them and their needs, you’re wasting your time

Go to market

- Pricing model

- Depends mostly on what the market will bear

- What’s the value of the benefits of your product or service to your customer?

- How much of that value can you “extract”?

- It costs you £1000 a year to supply your product. Your customer saves £10,000pa because of your product. Charge somewhere between £1,001 and £9,999

- Preferrably £9,999

- What do competitors charge?

- Important: Only the lower bound depends on how much it costs you to deliver your product or service

Go to market

- Ok, we know who the customers are and how much we are going to charge but…

- How do you reach these customers?

- How do these customers know that your world-beating product exists?

- Advertising, print, social media (LinkedIn ugghhhhhh)

- Word of mouth

- Cold calling

- Industry conferences

- Earned media

- You need a plan and it will be part of your Business Plan

- Your customer research will help here

Go to market

- You’ve found your customers and actually got a sale (of which more later)

- Cost of Acquisition vs Life Time Value

- How do you deliver the product or service?

- How do you deal with ongoing customer support?

- Unhappy customers

- Refunds

- Being taken to court because the customer hates your product

- Lots of things to think about here too

Go to market

- I found this definition online which I like

- “A go-to-market strategy (GTM strategy) is an action plan that specifies how a company will reach target customers and achieve competitive advantage. The purpose of a GTM strategy is to provide a blueprint for delivering a product or service to the end customer, taking into account such factors as pricing and distribution. A GTM strategy is somewhat similar to a business plan, although the latter is broader in scope and considers additional factors like funding.”

Selling

- At some point you end up “in front” of a customer

- Maybe a bit different for B2C businesses but essentially it’s the same

- You’ve got a chance to present your product or service

- Write a presentation for customers

- Be careful about emphasising the problems they face

- Emphasise the benefits to them

- Carefully compare to competitors – maybe their best friend works for the competitor or the competitor just took them to the Monaco Grand Prix…

- Personally I wouldn’t put pricing in the presentation but YMMV

- Ask for the sale

When they say no or maybe or later

- Nobody ever ever ever says “Yes, I’ll buy 10,000 of your widgets today, show me where to sign”

- What they actually say

- “Not sure we have capacity at the moment”

- “We have already got this thing”

- “Seems really expensive to me”

- “I don’t understand”

- “I don’t like <insert feature here>”

- “I’m not really the person who buys this thing”

- “This is very interesting”

- Mostly, this means “no”

- Sometimes it means “maybe”

Next steps

- Never finish a meeting without asking (or stating) the next steps

- The next step is what turns “maybe” into a “more likely maybe”

- If there’s no next step it’s a definite “no”

- Have a process or system

- Keep records of meetings

- Follow up the meeting with an email

- And then a phone call

- Unless it’s a real no, don’t take no for an answer

- Rejection is hard but get used to it

- It’ll happen a lot

Ways to deal with delays and maybes

- “I don’t like blue cars”

- “Blue is the best colour for cars”❌

- “If it wasn’t blue would you buy it?”✅

- “I’m not really the right person”

- “Who is the right person?” ❌

- “Can you introduce me to the right person?”✅

- “This is really interesting”

- “Oh good”❌

- “Can you see your firm buying this?”✅

- “We use your competitor”

- “They’re rubbish”❌

- “What is it that you like about the competitor?”✅

More ways to deal with delays and maybes

- “It’s too expensive”

- “Oh, ok”❌

- “But let me just go through the benefits again”✅

- “I don’t understand”

- “<sotto voce>Moron”❌

- “Maybe if I explained the benefits in a different way”✅

- “Great, we’ll get back to you”

- “Thanks”❌

- “When?”✅

- It’s all about keeping the conversation going

Special deals

- Early adopters

- Give them a special price?

- Give them it for free?

- “Proof of concept” or “Technology evaluation”

- Cornerstone or vanity customers

- Give them a special price?

- How transparent is your pricing?

- Do you really want to lie to your subsequent customers?

- Prices never go up later

When do customers buy?

- The terrible books will give you all these tricks

- But the tricks are just that

- Necessary conditions to buy

- The customer has to believe that there is a benefit to them

- The benefits of your product are better (for some definition of better) than the benefits of your competitors

- Customer believes that you will “take care of them”

- Customer likes you

Next lecture (24th April) – the boring but important stuff)

- Part 1:

- Legal structures

- IP protection

- Accounting

- Hiring, firing, leading, managing

- Disputes

- Part 2: The Cambrige Ecosystem

- Main players in the Cambridge Ecosystem

- Accessing the ecosystem

- What the ecosystem does well

- What it does

badlyless well.