- We will hire 3 developers at a total cost of £90,000 and our CEO will be paid £60,000

- I know that nobody will do this right now but you’ll wish you had in 2 years

Business Plans and Presentations

Entrepreneurship for mathematicians

Summary of today’s lecture

Part 1

- The business plan

- What is it?

- Why do you need it?

- What do you put in it?

Part 2

- Presenting

- Writing presentations

- Presenting presentations

- Golden rules of presentations

Business Plans

What’s in a business plan

- A business plan can be 1000+ pages or 5 pages

- Think of it as an organic document. Start small.

- It’s mostly tool to help you understand what you’re going to do

- Detailed financial projections for at least couple of years

- Market and customer analysis

- Risks, threats

- Financing needs

- Pricing, go to market, marketing strategy.

- Download a template from about a million places on the internet

- So let’s go through the main parts

The Executive Summary

- This is the bit that everybody reads

- Summarise as if the reader knows nothing about your business

- …because most readers won’t know anything about it

- Who you are

- What you do

- What stage you are at

- The market you are in

- Your customers

- Your “strapline”

- Your goal or “mission”

- High level financial summary

- If it doesn’t fit on a page, you’ve failed

Who you are

- The company name (surprising how often that’s left out)

- Physical location

- Online locations

- Contact details

- Company numbers etc

- The team

- Relevant history

- Specific rôles and why people fit them

- Advisors (if you think they help)

- Hiring plans in the future if relevant

What you do

- What is this business all about?

- Describe the product or service (or the proposed product or service)

- Features

- The things this product does. Its characteristics

- Advantages

- Why the features help your customer

- Benefits

- The gain that the customer gets from using your product

- This is the single most important thing

- Bring in relevance of the team’s experience in this product space

- This is not the place to do pricing strategy or go to market

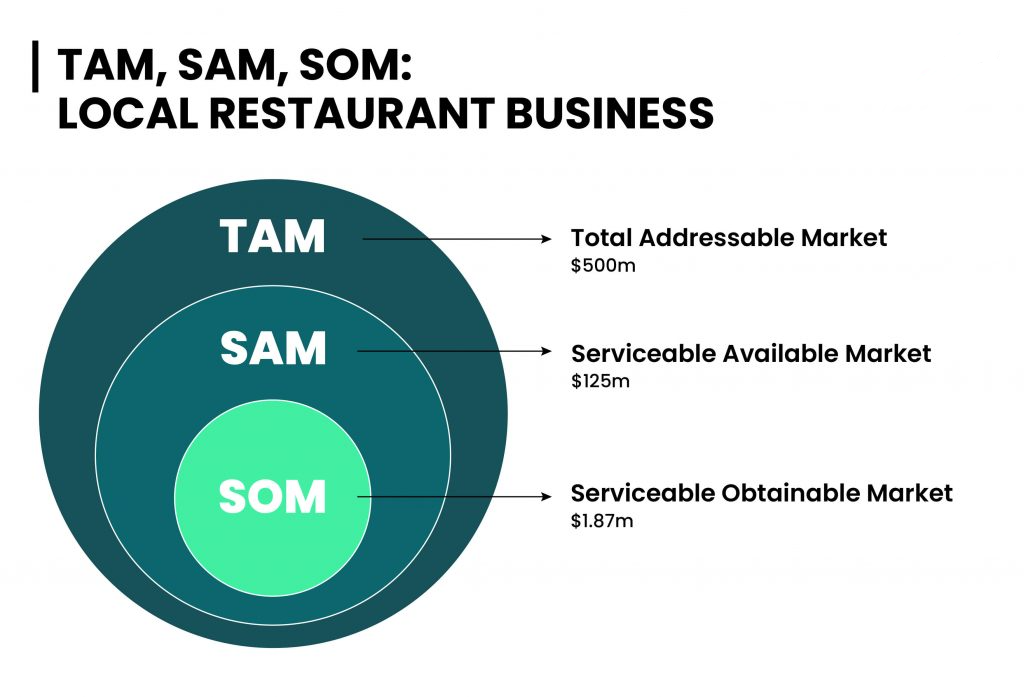

The market for your product

- Is this a B2B, B2C, B2G business?

- TAM: Total Addressable Market

- The total market for your product

- SAM: Servicable Addressable Market

- The portion of the market you can acquire with your business model

- SOM: Servicable Obtainable Market

- The percentage of the market you can realistically acquire

- These numbers are often wild, crazy and totally unrealistic

- And a common place to see a terrible chart crime – see later

Customers

- Describe typical customers

- Why are they going to buy your product or service

- What is the need that the customers have that you are fulfilling?

- No need then no sale

- Once you’ve started selling your product you can include examples here

- If you haven’t started selling but you’ve got people lined up to buy, this is where you mention them

- Market research

- Saying that you think customers will buy is pretty weak

- Talk to prospective customers if you are a B2B business

- Maybe pay for some surveys if you are a B2C business

Pricing Strategy

- How much does your product cost to “make”

- How much will you charge for it?

- Volume discounts

- One off vs recurring revenue

- Investors love recurring revenue

- Customers…not so much

- Competitive pricing?

- How many things are you selling now and will you sell in the future

- This data will feed into your financial modelling

- Actually better for your business plan to be fed by your financial model

Aside: Document Management

biz_plan_final_final_emk_edit_3.docx- DO NOT DO THIS

- Do not email documents or presentations to colleagues

- Use Google Docs, Microsoft sharepoint etc to work on one document

- Archive and save using Git or equivalent

- You want to be able to reproduce precisely what you sent to Alice Bloggs of Big Company Inc on the 29th of February 2024

- Save source (powerpoint, excel, charts) and the PDF

- Parameterise your documents

- Single Source Of Truth™️

Parameterisation 1

Parameterisation 2

from IPython.display import Markdown

from tabulate import tabulate

import pandas as pd

sheet_id = "1JcipzU0OWbHzzAqlHORnNgs322ax-J4ceqzbnS_z6aY"

df = pd.read_csv(f"https://docs.google.com/spreadsheets/d/{sheet_id}/export?format=csv")

business_data = df.to_dict()

CEOCost = business_data["CEOCost"][0]

DeveloperHires = business_data["DeveloperHires"][0]

DeveloperCost = business_data["DeveloperCost"][0]

...

Markdown(f'''

- We will hire {DeveloperHires} developers at

a total cost of £{DeveloperHires * DeveloperCost:,} and our CEO will be paid £{CEOCost:,}''')

...Financial Modelling

- In many ways financial modelling is pretty easy until it gets really very difficult indeed

- I hate spreadsheets with a passion…but this is the one thing that spreadsheets were actually designed to do

- Build a simple “model” of your business

- Financial periods along the top (normally months)

- Y axis is Revenue categories and cost categories

- Parameterise your spreadsheet and don’t hard code assumptions into the formulae

- Eventually, get an expert to do it for you

- A good in-house or outsourced CFO is critical

- This is also where you lay out your funding strategy and how you’re going to get to profitability

Financial Modelling Example

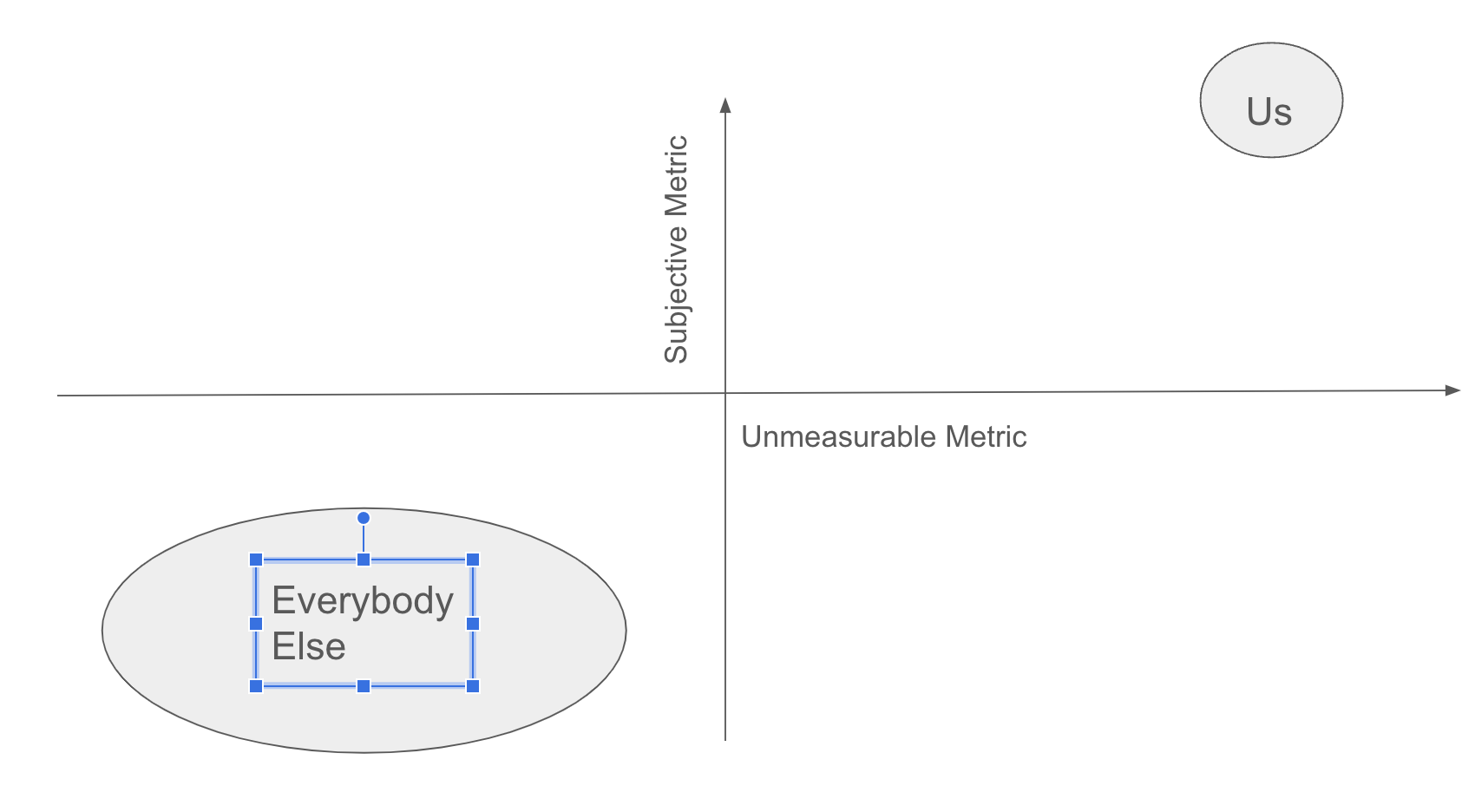

Competitors

- Who are your competitors?

- Strengths, Weaknesses, Opportunities, Threats (SWOT), Price, USP

- Take them seriously

- Avoid this

| Feature | Competitor 1 | Competitor 2 | Competitor 3 | Us |

|---|---|---|---|---|

| Important feature | ✅ | ✅ | ✅ | ✅ |

| Pointless feature 1 | ❌ | ❌ | ❌ | ✅ |

| Pointless feature 2 | ❌ | ❌ | ❌ | ✅ |

| Pointless feature 3 | ❌ | ❌ | ❌ | ✅ |

| Pointless feature 4 | ❌ | ❌ | ❌ | ✅ |

| Pointless feature 5 | ❌ | ❌ | ❌ | ✅ |

| Another important feature | ✅ | ✅ | ✅ | ✅ |

Go to market strategy

- How are you going to sell your product

- What channels are you going to use

- Word of mouth

- Industry contacts or conferences

- Social Media

- Billboards or TV

- Earned vs unearned media

- Do you have any experience marketing?

- If you don’t then hire somebody who does

- It doesn’t matter how good your product is, if nobody knows that they can buy it, you’re finished

- Lots of great ideas fail at this hurdle

Risks

- What can go wrong?

- Competitor ups their game

- Employees leave (good and bad leavers)

- R&D takes longer than expected

- Costs go up

- Prices go down

- Cyber attack

- Regulation changes

- Asteroid strikes your office

- Try to come up with a plan B (or as they say “a pivot”) before you need it

Operations

- Manufacturing

- Accounting

- Book keeping

- Regulatory compliance

- Human Resources and Payroll

- Tech infrastructure

- Business continuity planning

- Suppliers

- Consultants

But nobody reads it!

- Almost nobody reads it

- In the very late stages of discussing financing with investors, they’ll want everything mentioned previously and more

- But by then your business plan will be out of date. So you’ll scramble to update it and make mistakes

- Start simple (a few pages, a simple financial model) and add detail incrementally

- Keep it up to date

- Parameterise your business plan, parameterise your financial models. Single source of truth

- However, you don’t get to the late stages without the early stages which critically depends on….

- THE DECK

- It’s the greatest hits compilation of your business plan

Presenting

Two tasks

- Write the presentation

- It should really be a very concise summary of your business plan if it is for investors

- What do you want to say?

- Decide on brand, colours, fonts, layouts

- Think about audience

- Make the presentation a story with a beginning, middle and end

- Every slide should have a “point”: what the audience supposed to take away from this slide

- Present the presentation

- Tech

- Style

Rule 1: It’s not about the presentation

- Powerpoint, Slides, reveal.js, Quarto etc have transformed presentations

- However, the information comes from the presenter not the presentation

- You should be able to give a great presentation without any slides or supporting materials

- If you can’t talk about your business without materials for 30 minutes in a structured and compelling way then maybe rethink your career choice

- But you can use a presentation to enhance or illustrate the points you want to make

- The downside of Powerpoint and Slides is that you can do anything with them which often destroys any coherence and becomes distracting

Rule 2: Talk to the audience

- I don’t mean “don’t talk at your shoes” but engaging with the audience is important

- Work out who the audience is and what they’re interested in

- Don’t give a customer focused presentation to investors

- Don’t give an investor focused presentation to customers.

- Don’t talk too much about your product to investors: they’re unlikely to be users of it

- Customers don’t really care (much) about your venture funding requirements and your cash flow projections

- If you get this wrong, everybody is confused or (worse) bored

- Don’t try to have one multi-purpose deck

Rule 3: Attention spans are microscopically short

- This isn’t because people are bad or stupid, it’s because the people you’re pitching to see a lot of pitches

- VCs and customers might see 8 or 10 pitches a day

- You’ve got to assume that the people in front of you are a bit bored, tired, grumpy and have already seen some pretty good presentations

- Golden Rule! “Answer First”

- Most people don’t read the whole deck

- Make the first slide count

- Some people actually do read the whole deck

- Consistency of numbers, axes on charts.

Rule 4: Bite sized pyramid chunks (toblerone!)

- The “pyramid principle”

- Break your presentation into shorter chunks with a beginning, a middle and an end. Maybe 2 to 3 minutes long.

- This gives you natural “beats” in the presentation

- People get lost in long presentations (“what’s the point of this again?”). Help them out.

- What is this particular slide about?

- Last slide is critical

- It’s the one that’s going to be up on the projector while you’re doing Q&A

- It’s the “call to action”

- Make it count.

Rule 5: The Three Tells

- In each bite sized chunk:

- Tell them what you’re going to tell them (answer first)

- Tell them it

- Tell them what you’ve told them

- Or in other words

- Introduce the topic

- Talk about the topic

- Summarise the topic

- Keep re-summarising previous topics

- This is not a academic paper or an academic presentation

Rule 6: One Slide, One Minute.

- At absolute maximum you can do one slide in one minute

- This assumes people don’t interupt you with questions in the middle

- If you’ve got a 15 minute slot to present and 50 slides, you’re toast

- Realistically people will want some time for Q&A so a 20 minute slot is probably only 10 or 15 slides

- If you need supporting and supplimentary data or charts, put them in an appendix

- Critical: Each slide needs to say something.

- What is the one message do I want the audience to take from this one slide?

Rule 7: Practice

- Don’t practice on your own

- Get some rude, sceptical and critical friends, colleagues or mentors to listen and comment

- Ask them to listen to the whole presentation then comment

- However long the presentation takes when you practice it, it will be 50% longer when you actually do it

- Don’t get too wooden by practicing too much

- If you had practiced saying something and you forget in the heat of the moment, don’t get flustered

- Imagine you’re describing what is on the slide rather than reading it

- Don’t be like a contestant on the Apprentice!

Rule 8: Don’t read out the slides

- Please, don’t read out the slides

- It is unlikely you will be pitching to somebody who is illiterate or blind

- When you’re practicing remember you are talking with the slides, not from the slides

- You’re using the slide summarise what you want to say

- It’s the essence of the message, not the total message

- If you use speaker notes, then remember they’re notes not a script

- Don’t read the notes out either

Rule 9: Fonts, colours, design, charts

- One or two fonts in one or two sizes used consistently throughout

- One or two slide layouts

- Number your pages

- Don’t use a dark background

- Use images with care

- Check aspect ratios (16:9, A4 etc)

- Charts labeled, clear, legible, relevant

- Never use cheesy clip art or inspirational photos or meaningless icons

- Avoid clichéd or meaningless diagrams

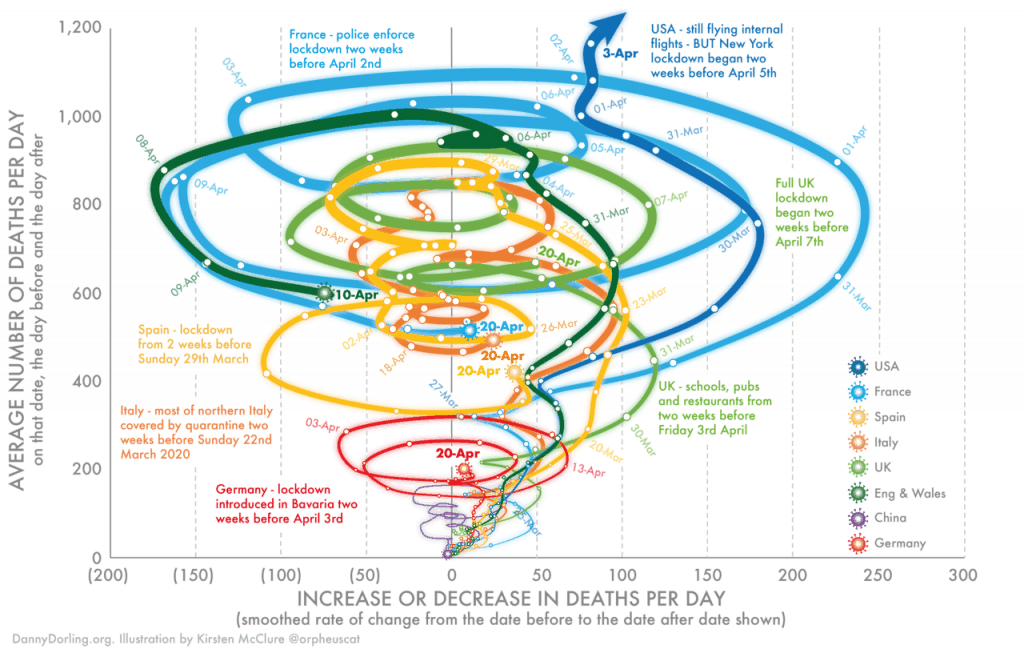

Chart Crime 1

Chart Crime 2

Chart Crime 3

Chart Crime 4

Rule 10: Technology

- Be very very careful with your own laptop

- Open tabs on your browser

- Bookmarks bar

- Notifications

- Other programs

- 25,389 unread emails

- Check your laptop is compatible with the tech if you’re not in your own environment

- Demos and videos are great but dangerous

- If you’re emailing a presentation, send a PDF not a PPT and name it sensibly

- Compress files you send. This presentation compressed from 5mb to 500k using Adobe’s free tool

Example of a bad presentation

Removed from public distribution

Next Lecture

- Part 1:

- Equity vs Debt vs Grants

- Who do you raise money from?

- Pitching for investment

- How to handle equity and dilution

- Part 2:

- A lot of this entire course is going to be about “selling”

- Selling (or marketing) is the heart of everything as an entrepreneur

- Customers

- How to understand and manage the interactions with customers

- Closing deals

- Discounts, special deals, cornerstone customers